Decision making is an unavoidable part of life that can either improve or reduce the quality of your life. We live in a world now where everything is geared towards immediate gratification. As tempting as it is to make short term decisions that benefit our current situation, it is often wise to consider the longer term effects of our decisions.

The human brain is hardwired to seek short term pleasure and avoid short term pain, which can lead to the self-sabotage of your long term wealth ambitions. However, by understanding how human behaviour works you can help prevent making mistakes on key economic decisions in your life, which is often a result of choosing short term pleasure over long term gain. Instead of making decisions for first order consequences (short term), the challenge is to consider the second or third order consequence of your actions (long term). For instance, if I decide to eat a doughnut, the first order consequence is instance gratification from the sweet sugar rush, however the second order consequence is the excess calories and unhealthy nutritional value of the food which affects my health in the future. Thinking of the second order consequence makes the decision to eat the sugary treats less appealing. From a financial perspective, financing a BMW when your 23 to impress your friends may seem like a decent decision at the time (after all you’ve worked hard for it) however the misuse of capital could prevent you from experiencing the benefits associated from compound growth on an investment FOR THE REST OF YOUR LIFE.

Clinical studies over the years have proved that principles such as patience, sound reasoning and long term planning are strongly aligned to success in life. Stanford University in the US conducted an experiment on young children using rewards to explore the idea of delayed gratification and its effect on their success in life. The children were offered a choice between a small reward received immediately (often marshmallows) or two smaller rewards at an unknown later date. It was found that the children who displayed patience by opting for a larger reward in the future statistically had better life outcomes (measured later through education scores, BMI, average salary etc.). These children unknowingly showed patience by “seeing the bigger picture”, principles proven to build sustainable wealth.

Although a relatively simple exercise, the lessons we can learn from the idea of delayed gratification are profound. We see the principles of this experiment play out so clearly in our own financial choices, as well as that of others. The savvy investors will sacrifice the “nice-to-haves” now for the opportunity of a financially better future.

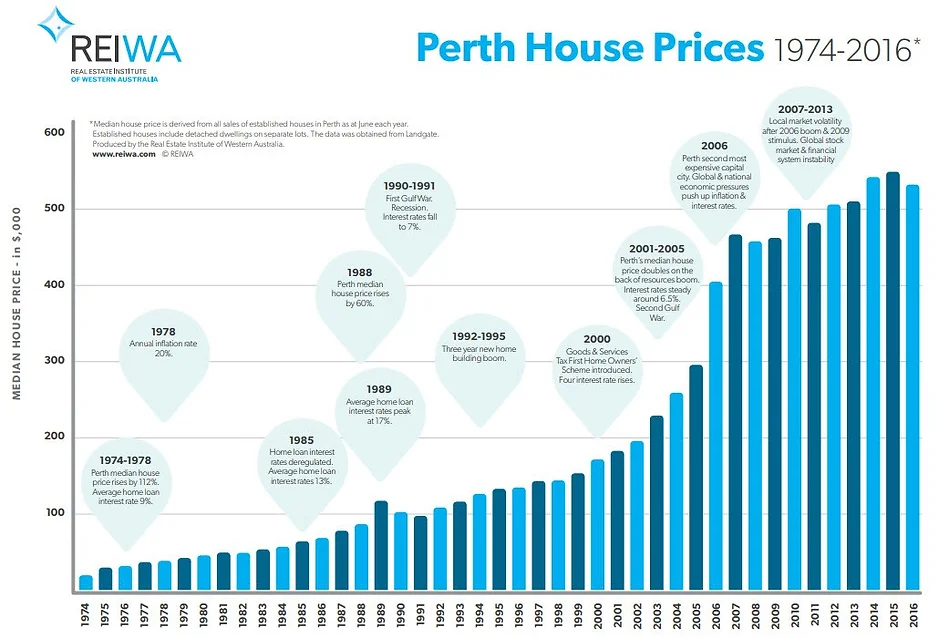

The purchasing of property requires sacrifices in all aspects of your life. Saving for a deposit and allocating a portion of your earnings for mortgage repayments takes fiscal responsibility but also the patience and self-control to avoid short term temptations to grind out the process. Once purchased short sighted investors who seek instant cash returns can get bored of the wealth building process and seek to cash in their chips. This is in my eyes is financial suicide and is extremely short sighted. Property investment is cyclical in nature, as markets move up and down constantly. Predicting the short term ups and downs is gambling, as factors outside of our control can often have a HUGE influence on them (i.e. a recession or credit crisis in China). However, what has proven historically correct and is very predictable is the long-term (20+ years) increase in property values. It is therefore beneficial for investors to take the long-term view and hold their assets through the market cycles. When it comes to investing, especially in property, one of the biggest influences on increasing your wealth is TIME (thanks to the undeniable principles of compounding growth). As the saying goes, it is better to have time in the market as opposed to trying to time the market.

It’s true, the Perth market has not been generous to investors over the past 10 years. The median house price has gone up and down over this period however has for the most part remained flat. However, it is often times like this when the market is pessimistic that the principles of patience are so critical.

A common misconception is that Perth has poor price growth when compared to other major capital cities. This profound lack of perspective, driven by our short term memories, is factually incorrect. The Australian Bureau of Statistics’ Established House Price Index for the period 2002 to 2017 shows Perth median house price grew by 159% compared to 142% in Sydney. In fact, Perth Brisbane and Darwin were all virtually equal third over this period. Sydney’s much hyped recent price growth was a function of flat growth for the 10 years that preceded the “boom”. Sound familiar Perth investors? Guess what Sydney investors were saying in 2006 when Perth had the 2nd highest median house price of all Australian capital cities ad had experienced 35% growth in 1 year. Since 2006, Perth has dropped from being just 80% of Sydney’s median house price to only 50%, and is now ranked 4th of all capital cities.

Time for some perspective... Knowing that:

-

All markets move in cycles;

-

Not all markets move in sync; and

-

Property prices for any given Australian capital city increase over the long term;

Where do you think the Perth property market is heading over the next 10/15/20 years? Having perspective allows you to see the bigger picture and avoid getting caught up in what’s HOT right now.

Decisions have the ability to influence and shape the conditions of your life and those around you. So the question you have to ask yourself is; are you going to eat your marshmallow now? Or alternatively, will you show the patience and perspective proven to provide long term wealth generation? Poor decision making, driven by the desire for first order consequences, could end up costing you dearly in the long run. As Dr Stephen Covey eloquently stated:

“Happiness can be defined as the fruit of the desire and ability to sacrifice what we want now for what we want eventually.”